How to Create a Sales Funnel for an Investment? 90% Burn Their Opportunities

Every investor decision begins with uncertainty. No matter how promising your venture appears, capital does not move without conviction. That conviction must be earned. Deliberately, systematically, and with purpose.

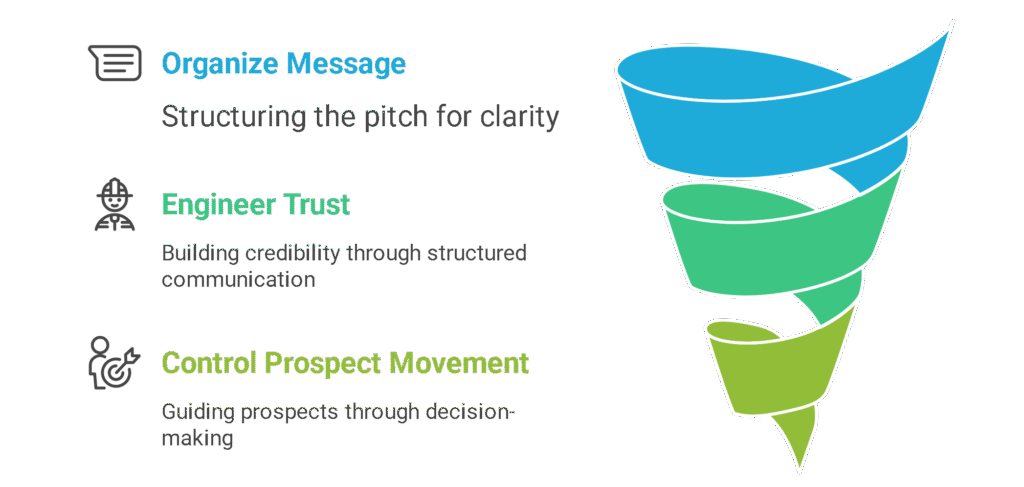

This is where many fail. Not because the opportunity lacks merit, but because the process fails to guide. A well-structured sales funnel does not merely display an offer. It shapes perception. It moves attention forward, one informed step at a time.

In the guide ahead, you will learn how to create a sales funnel for an investment that is high-calibre, reduces hesitation, and amplifies credibility without overpromising.

Key Takeaways

Why You Need a Sales Funnel for an Investment

An investment pitch without structure relies too heavily on chance. Investors don’t respond to isolated information; they respond to context, sequence, and clarity.

A sales funnel does not just organize your message; it engineers trust. It provides control over how prospects move, think, and decide. The absence of a funnel does not merely slow progress. It breaks it.

Here is why a sales funnel is essential for an investment offer:

Unlock investor attention with funnel templates engineered to persuade, not just inform. Command conversions from your first click to the final close.

Pro Tip

Front-load your funnel with recognitions, affiliations, or media coverage. A subtle line in your email signature or a trusted logo on your landing page lowers resistance before you make any direct ask.

How to Create a Sales Funnel for an Investment

A strong investment offer without a structured funnel is like a polished product with no storefront. Here is how to build one that does more than inform:

Define Your Investor Profile

Not every investor fits your model. Identify the characteristics of those who align with your risk level, vision, and capital needs. Are they institutional or private?

Metrics-driven or mission-focused? Knowing this determines not only where to find them – but how to speak to them.

Read this: How to Choose the Right Sales Funnel for Your Brand? Most Get This Wrong

Map the Investor Journey

Investors don’t say yes after one touchpoint. Their decision process involves discovery, skepticism, analysis, and reassurance.

Design your funnel to meet those emotional and intellectual milestones in sequence. Not randomly.

Build the Top-of-Funnel Entry Points

This is where awareness begins. Think leadership articles, targeted ads, podcasts, data reports – whatever draws attention from qualified eyes belongs here.

But it must connect back to a central offer. Interest alone is not the objective. Controlled progression is.

Create a Compelling Lead Capture Layer

Once interest peaks, you need commitment – however small. A name. An email. A scheduled call. Use a landing page with a focused value proposition. No distractions.

Every element should answer this: why now, why you, and why this opportunity.

Design a Nurture Sequence

Once inside your funnel, prospects expect clarity. Create an email sequence that educates without overwhelming, and leads logically to your investment presentation. Each message should feel personal, not automated, even if it is.

Deliver the Offer with Precision

Now comes the pitch, but not a generic one. Create a dedicated offer page that includes a narrative, timeline, returns breakdown, risk disclosure, and social proof.

Use video if possible. Make the experience frictionless. The fewer questions left unanswered, the higher the trust earned.

Read this: How to Create A Sales Funnel for A Catering Company? Quick Tutorial 2026

Handle Objections Before They Surface

Objections rarely come out loud. They simmer quietly and kill momentum. Anticipate them in your funnel.

Address risks, liquidity concerns, timelines, and legal structure through FAQs, testimonials, and third-party validations embedded throughout the journey.

Implement Follow-Up Logic

Silence is not the end. Create conditional follow-ups based on prospect behavior. If someone clicks but does not book, send an alternate path.

If they view but do not act, deliver added context. Your funnel should adjust, not just react.

Optimize with Real-Time Data

Funnels are living systems. Track everything: open rates, click-throughs, bounce points, drop-offs. Use the insights to refine language, adjust pacing, or rework steps. The most effective funnels evolve constantly.

Only 1 in 10 funnels convert cold leads into actual investors. Flip the odds in your favor – explore our professionally tested custom funnel templates built for conversion.

Common Mistakes to Avoid When Building An Investment Sales Funnel

A poorly structured funnel does not just underperform; it erodes trust. And trust is the only currency that matters when you are asking someone to allocate capital.

Here are the common mistakes you should avoid, if you do not want your funnel to fall flat:

Pro Tip

Ask for referrals once value has been delivered. Well-timed referral requests earn higher response rates. Additionally, referred leads arrive with built-in trust and faster decision cycles.